Background

Equity Compensation is a tried and tested tool to ensure the attraction and retention of key talent and drive their performances. Amongst the various instruments available in the space, Restricted Stock Units (RSUs) are gaining more and more popularity. RSUs, as an instrument, effectively ensure lower dilution for existing shareholders and provide an adequate safety net to the option holders against market movements. This can be backed by the fact that in the recent past, many of the listed companies (HDFC Bank, ICICI Bank, KPIT Technologies, Persistent Systems, HCL Technologies) have been able to secure the mandate from the shareholders to implement the tool. In this write-up, I will highlight the beauty of RSU as an instrument and the expectations of various stakeholders, including the requirements from a corporate governance standpoint.

Introduction

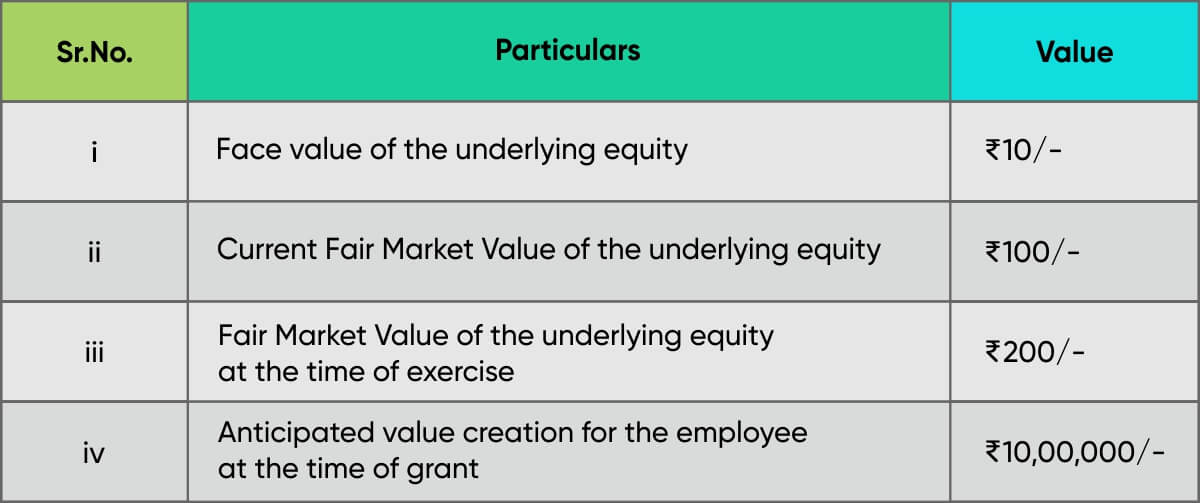

In India, RSUs refer to the stock option, which is granted with an exercise price at a deep discount to the Fair Market Value (FMV)/Current Market Price (CMP) of the underlying equity. Typically, these options are granted at Face Value (FV) of the underlying equity. I am sharing an illustration below to highlight the features of RSU as an instrument.

Assumptions:

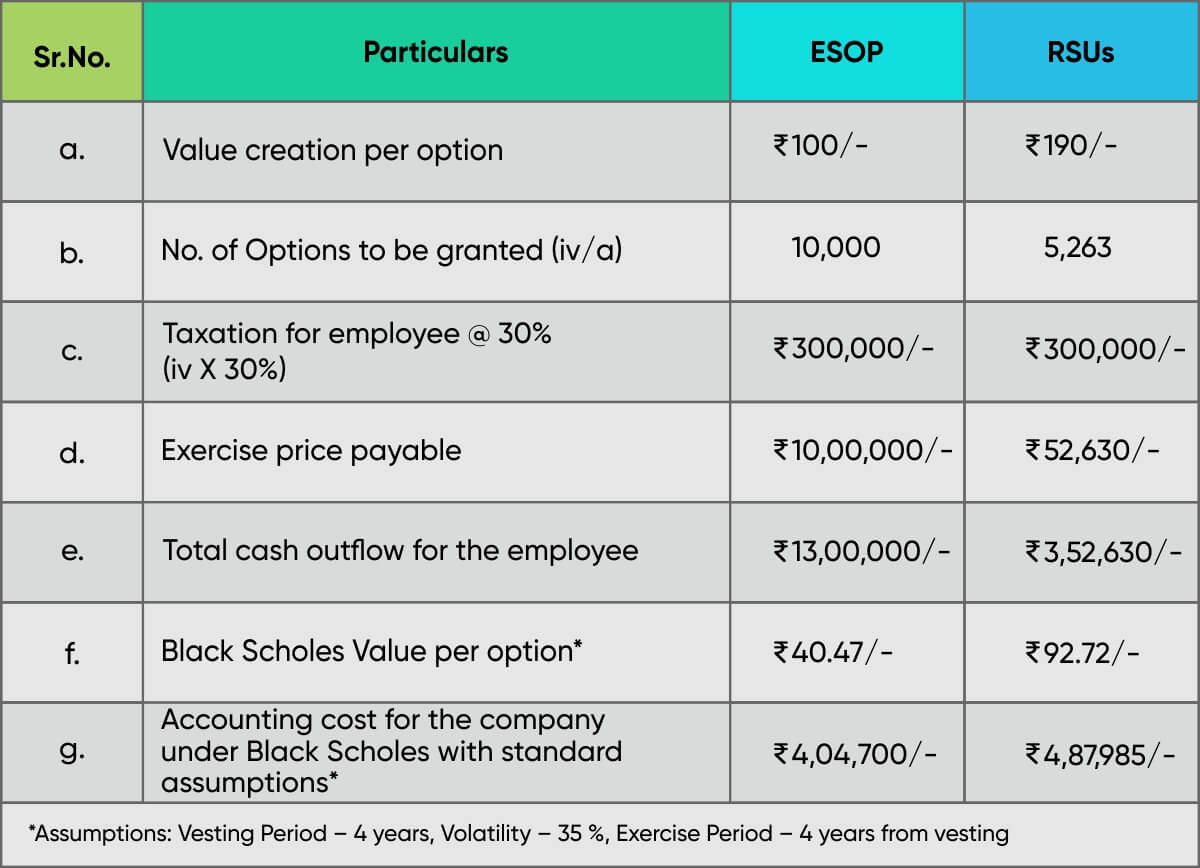

Comparison of ESOP v. RSUs

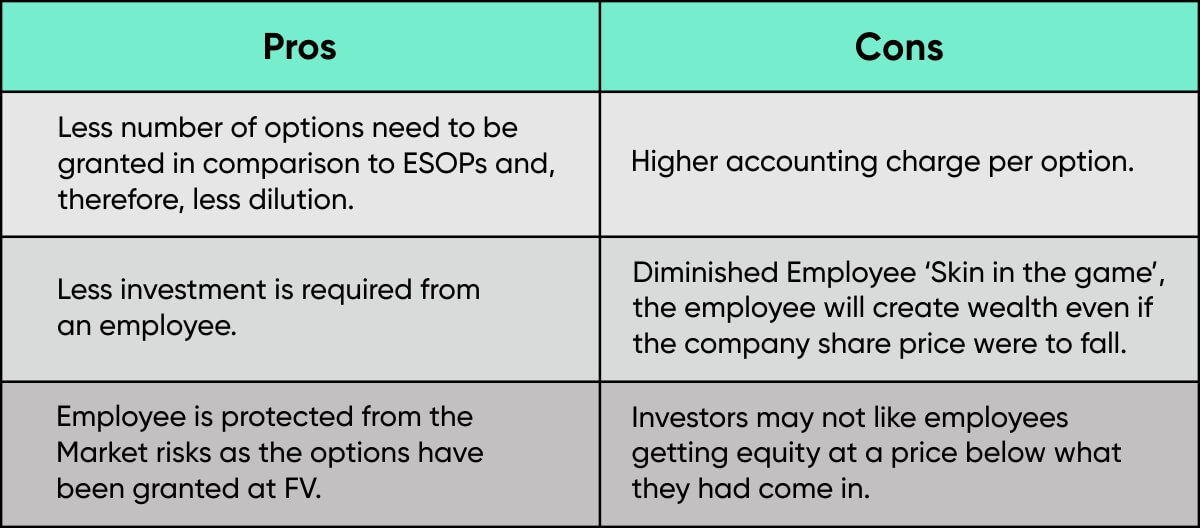

Pros and Cons of RSUs as seen from the above Illustration

Why are Companies looking at RSUs?

Companies are looking at RSUs as a choice of instrument for two significant reasons:

- Lesser Dilution Appetite – The management of the Company is desirous of reducing the dilution for the existing shareholders, and as seen in Illustration 1, RSUs are the least dilutive equity-settled instrument.

- In money options – Option grantees value RSUs more as they are in the money from Day 0 and call for lesser investment from them.

Proxy Firm expectations from RSUs in a listed Company

In the case of listed Company shareholder resolutions for implementing a stock option program, the proxy firm provides its opinion on the proposed scheme. Their opinion is looked upon before the shareholders vote. On an in-depth analysis of the proxy firms views in around two hundred and sixty resolutions, we could come out with a white paper on the proxy firm expectations; the link is shared herewith (https://www.esopdirect.com/wp-content/uploads/2021/06/Whitepaper-proxy_firm_view_on_ESOP_resolutions_trends_in_India-1.pdf). You can as well view the presentation through this link: https://www.youtube.com/watch?v=kswdu8cJsqc&t=2439s.

To summarize the observations, below are certain specific expectations of a proxy firm in the case of an RSU plan:

1. Broad based coverage

Proxy firms expect the Company to implement these plans for broad-based coverage and not limited to senior leadership. In fact, the plans which had broad-based coverage, however, excluded the leadership roles were voted in favour of by the proxies

2. Concentration of allotment – maximum grants per individual – maximum benefit to a single individual

Proxy firms have appreciated companies who have disclosed the maximum options that may be granted to a particular individual so that the shareholders know the wealth creation for an individual through the proposed grant. For instance, the Company should disclose the maximum number of options which could be granted to an individual in a particular financial year.

3. Direct linkage to corporate performances

Proxy firms outrightly express a negative opinion on the schemes where the grant/vesting conditions aren’t linked to performances. They wish to get a clear picture of the performance conditions at the time of getting the same approved from shareholders, including whether it is linked to corporate performances (linked to ROE, EBIDTA, peer comparison etc.) or individual performance parameters.

4. Past practice

Proxy firms, in their reports, have mentioned that they also evaluate existing practices/policies of the Company around long term incentive plans, equity compensation while forming an opinion on the new LTIP/RSU Schemes

5. Vesting period.

Proxy firms are keen that such schemes have an extended vesting period; in a particular case, they have highlighted that the vesting period was shorter, and the Company can look at a vesting period of more than 3 years.

RSUs and Corporate Governance

RSUs promote corporate governance in an organization.

1. Transparency with the stakeholders

As seen from the above, proxy firms scrutinize the scheme documents in detail whenever a Company seeks approval for an RSU plan. It is expected that the Company discloses as much information as possible around the objective, coverage, vesting period and conditions, quantum, etc.

2. Performance based conditions

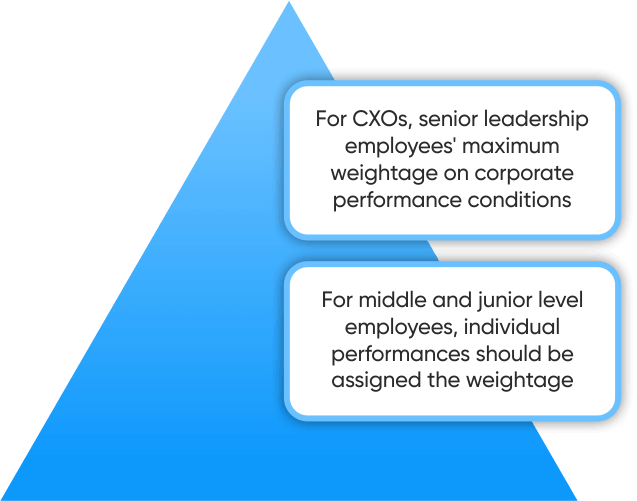

A company needs to look at pre-defined performance-driven conditions regarding the grant or vesting of such RSUs. Shareholders give corporate performance conditions significant importance before approving such schemes. It is preferred by the shareholders to have these conditions specified in the explanatory statements of the resolutions rather than keeping them flexible and at the discretion of the Board of Directors / Nomination and Remuneration Committee.

Companies should look at factors such as Return on Investment, Return on Equity, EBIDTA, Free Cash Flows, etc.; in case of corporate performance conditions, the same can also be benchmarked with peer company performances through relative TSR or peer matrices. Individual performances can be linked to each employee’s KRAs, KPIs, and OKRs.

3. Broad based coverage

As stated above, Proxy firms want such plans to be broad-based. Hence, such plans ensure more comprehensive coverage rather than the concentration of these discounted options in the hands of a few. They also prefer freezing the maximum quantum of grants under such plans to provide a clear picture to the shareholders as to maximum wealth creation per option holder on the day of the grant.

In a particular case, they appreciated the fact that the leadership team were specifically not covered under the Company’s RSU plan.

4. Dilution Optimization

RSUs, as an instrument, are in the money from day zero. As such, whenever a Company contemplates granting such options, the pool utilization compared to FMV / CMP grants will be lesser in RSUs. This is because the value creation per option is much more in the former than in the latter; hence, the pool could be used for a longer duration.

5. Reduction in cash cost

Any equity-settled plan will reduce the cash cost, as the cost herein is notional. As per the judgements by the Hon’ble High Courts in Kotak Mahindra Bank and Biocon case, this cost is a tax-deductible expense and can be claimed by the Company.

Conclusion

As discussed above, RSUs, as an instrument in the long-term incentive space, are a win-win instrument for the employees and the Company. Proxy firm evaluations/investor evaluations of these plans ensure that the scheme is designed with an overall objective aligned with the Company’s growth, thereby providing excellent corporate governance from a policy standpoint.

| Author | Abhishek Sarda |

|

A Chartered Accountant by certification and with a degree in law, Abhishek has been with ESOP Direct for more than six years and is a part of the Business Development team.

View his detailed profile on LinkedIn at https://www.linkedin.com/in/abhisheksarda9391/ |