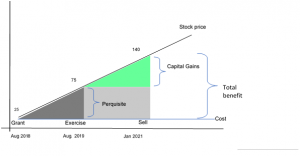

Employee stock options (‘ESOPs’ or ‘Options’) [we have used ESOPs as a common term for various equity-settled instruments] are very common instrument for sharing wealth generated by employees, by way of compensation. Like any other salary component, ESOPs are also taxed as regular income upon exercise and long-term capital gains (‘LTCG’) or short-term capital gains (‘STCG’) upon sale of shares acquired at the time of exercise. We will study about taxation in detail later, but let’s first understand the stages in the life of an ESOP which will help in understanding the taxation part.

Any Option has four stages in its entire life cycle:

- Grant: It is an offer made to the employees to be part of the employee stock option plan (‘Plan’) where such employees are eligible to exercise the Options as granted and vested. Grant is the stage where the company decides the number of Options to be granted, price at which such Options can be exercised i.e. exercise price, vesting period, schedule and conditions, exercise period/ mechanism etc.

- Vesting: It is the stage where the employee earns the right to exercise the Options upon fulfilment of certain conditions basis time and/ or performance.

- Exercise: Employee actually gets opportunity to exercise and convert the vested Options into shares by paying the exercise price and perquisite tax at the time of exercise.

- Sale: Once the employee receives the shares of the company upon conversion of Option at the time of exercise, the employee can hold/ sell or transfer such shares subject to applicable laws and terms of the Plan. LTCG or STCG tax will be applicable basis period of holding of such shares.

Now that we have understood different stages in the life of an Option, let us move to taxation of Options.

Taxation of Options

Income from Options are taxed twice to the employee, once, at the time of exercise when such Options are converted into shares and second, at the time of sale of shares acquired upon conversion of Options.

Stage-1: At the time of exercise

Perquisite income from Options = [Fair market value (‘FMV’) of share at the time of exercise less exercise price] X No. of Options to be exercised

Tax on perquisite income = Tax as per normal slab rate for individuals (as applicable)

Stage-2: At the time of sale of shares

Capital Gain on sale of shares

- In case of shares of listed company

- Long-term capital gains where shares are held for more than 12 months;

- Short-term capital gains where shares are held for 12 months or less.

- In case of shares of an unlisted company

- Long-term capital gains where shares are held for more than 24 months;

- Short-term capital gains where shares are held for 24 months or less.

| Tax on capital gains | ||

| Particulars | Tax on LTCG | Tax on STCG |

| Shares

(Listed company) |

10% over and above Rs. 1 Lac | Specified rate : 15% |

| Shares

(Unlisted company) |

20% (with indexation of cost) | At normal slab rate for individual |

Other cases

- In case vested Options are settled in cash at the time of exercise or any other time by the company, tax on perquisite income would be the appreciation as paid in cash by the company.

- Taxation in case of Stock Appreciation Rights are similar to ESOPs where tax is to be paid on the perquisite income of appreciation in share price i.e. (FMV of share on the date of exercise less Base price) X No. of Options to be exercised. Further, tax on sale of shares as per LTCG or STCG is same as in case of ESOPs.