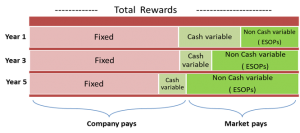

ESOPs, broadly known as Equity based compensation, are often looked upon as variable non cash compensation in the Total Rewards strategy. Variable, because its value varies with growth in the business valuation. Non-cash, because any Equity based instrument, by default, is encashed through trading in the stock market. So the buyer of that instrument, not the employer, pays the employee. There is no outflow for the Company.

Every company would like to strike a balance between Fixed and Variable pay. Within Variable pay, the preference would be to have a sizeable non-cash portion. In some sectors it’s the industry practice to have a larger variable component across all grades and designations. In other cases the Pay philosophy gradually evolves into that model. Several traditional sectors (for instance Construction, Trading) the pay structures continue to be fairly heavy on the Fixed compensation side. In general, the Total Rewards composition evolves on the lines as presented here for steady state companies. In some sectors, in early stage companies, portion of Fixed cash component is already lower than the Variable and ESOP portion in the initial years. Over the years, this portion gets reduced and replaced by Cash component. Contrary to what the picture above depicts

While this is the intended evolution, what does it take to achieve it? In other words, is it possible for a company to reduce Fixed pay and increase the variable portion and within that can the non-cash variable portion replace the cash variable? If so, what does it take to get there? In this discussion we are not addressing whether company should move in this direction. That is presumed to be a given.

First step is to reshuffle the Variable pay allocation by increasing the Non-Cash (ESOP) portion and reduce the Cash (Performance bonus) portion. Prima facie this should not take much convincing because end of the day both are linked to Company performance. However, a deeper look brings out the differences between the two.

- Assuming Performance conditions are met, Performance bonus is a cash in hand for the employee, tangible and real. Where as ESOP is first an Option then a share and then cash. Step from Option to share involves payment by the employee of exercise price. Step from share to cash pre supposes a market and liquidity for the shares. While the first hurdle of paying the exercise price can be overcome by enabling cashless exercise, ensuring liquid market for the shares (of unlisted companies) is a must to realize cash.

- The link between Company performance and increase in Stock price is not exactly linear. Though, more often than not both move in the same direction, there could be extraneous factors which impact the stock markets and take them to a direction different than company performance. A situation where stock prices appreciate in spite of an ordinary performance is also a reality in some cases.

In both these differences, employees have a little or no control either on providing liquidity to the shares or making market behave in line with performance. Hence, they are not very keen on taking risks. Having said that, it is also seen that given the disproportionate increase in company valuations (especially in unlisted companies), employees prefer ESOPs over the normal Performance bonuses, which are capped as a % of Fixed pay.

The second step of reducing the Fixed pay and increasing the Variable pie (non-cash variable) is more difficult as it may impact the monthly take home of employees. This is likely only at senior levels where sensitivity of a reduced monthly take home is not very high or where ESOPs are almost close to cash in terms of certainty.

ESOPs can certainly help in reducing the Cash compensation if companies can address the apprehensions mentioned above. Providing or ensuring liquidity for shares is a pre requisite for implementing an ESOP Plan especially in unlisted companies. The liquidity can be provided through Company buy backs, purchase by existing or incoming investors, IPO, cash settlement of Options. As far as lack of co relation between Performance and stock price is concerned, no one can assure that they move in one direction. It is preferred that this risk is adequately explained to the employees and they are aware of its implications. It is possible to provide a safety net kind of mechanism but that is a debatable approach.

Globally, use of ESOPs have helped companies reduce Cash compensation. In India as well, companies who have implemented ESOPs for over 7-10 years, where employees have seen higher cash in hand much higher than standard performance bonuses, this has been achieved. So, the answer to the question cannot be generalised. Its neither an emphatic yes or no – maybe, possible, achievable.